Welcome to the world of Options Trading, where financial possibilities unfold like a captivating story. In this article, we’ll unravel the intricacies of options trading, making it as simple as you can understand as a beginner trader.

Basics of Options Trading

Options trading may sound complex, but fear not – we’re breaking it down into bite-sized pieces. Let’s kick things off by understanding the very basics of options trading.

1. What are Options?

Options are like financial wands – granting you the power to buy or sell assets at a predetermined price. It’s the genie in the lamp of the financial market, waiting for your command.

What is options trading in simple words?

If you are looking for a simple options trading definition, it goes something like this: Options trading gives you the right or obligation to buy or sell a specific security at a specific price on a specific date. An option is a contract tied to an underlying asset, for example, a stock or other security.

2. What are Call and Put Options?

What is Call Options: Think of it as ordering pizza. You pay a premium for the right to buy a pizza at a specific price. A call option is the right to buy an underlying asset or contract at a certain price at a future date, but at a price that is decided today.

What is Put Options: On the other hand, is the right to sell an underlying asset or contract at a certain price at a future date, but at a price that is decided today.

It’s the anti-pizza move. You pay to sell a pizza at a set price. A bit counterintuitive, but that’s the charm of options.

3. The Art of Option Premiums

Option Premiums: The cost of the magical ticket. Pay this, and you’re in the options game. It’s like the entry fee to the financial theme park.

An option premium is always quoted on a per-share basis. So, when you say Reliance 1200 call June-21 is trading at Rs. 18, it means you have to pay Rs. Right to buy 1 share of Reliance Industries at the strike price of Rs 18.

4. Strike Price and Expiry Date

Strike Price: This is your price prediction. If your prediction hits the bullseye, congratulations! You’re in for some financial fireworks.

Expiry Date: The clock is ticking. Options come with an expiration date – make your move before the curtain falls.

5. The Greeks in Options

Meet Delta, Gamma, Theta, and Vega – the Greek squad in options trading. They measure risk, change, time, and volatility. No, not your usual toga party – it’s all about understanding the market forces.

Pros and Cons of Options Trading

Options trading, often described as a financial frontier teeming with opportunities, is a strategic playground for those seeking to navigate the complexities of the market.

Like any investment avenue, options trading comes with its set of advantages and challenges, requiring a keen understanding for traders to harness its full potential.

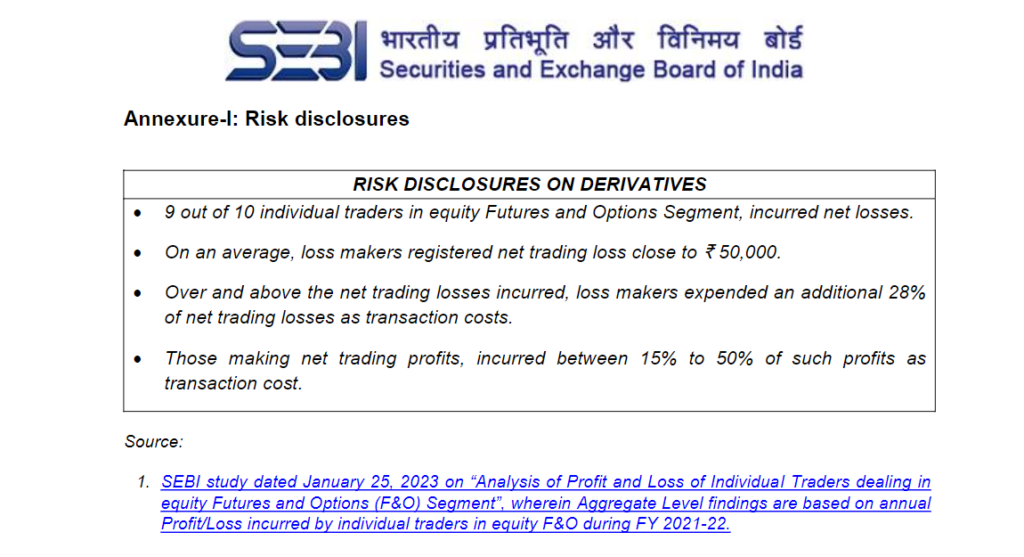

Read SEBI’s disclosure regarding FNO trading-

In this exploration, we’ll discuss the landscape of options trading, delving into the pros that make it an enticing prospect and the cons that demand careful consideration.

Whether you’re an experienced trader or a curious novice, understanding the basics of options trading is crucial for making informed decisions in the ever-evolving world of finance.

Let’s embark on this journey to uncover the benefits and pitfalls that define the realm of options trading-

Pros of Options Trading:

1. Leverage: Options allow traders to control a larger position with a smaller amount of capital, amplifying potential profits.

2. Flexibility: Options provide a variety of strategies, allowing traders to adapt to different market conditions and meet specific financial goals.

3. Risk Management: Options can be used to hedge against potential losses in an existing portfolio, providing a level of risk management.

4. Income Generation: Selling option contracts can generate regular income, providing an additional revenue stream for traders.

5. Limited Risk: When buying options, the risk is limited to the premium paid, providing a defined and manageable risk level.

6. Diverse Opportunities: Options can be used for various purposes, including speculation, income generation, and risk management, offering a range of trading possibilities.

Cons of Options Trading:

1. Complexity: Options trading involves a learning curve, and the complexity of strategies may be overwhelming for beginner traders.

2. Time Sensitivity: Options contracts have expiration dates, and timing is crucial. Failure to execute trades at the right time can lead to big losses.

3. Potential Losses: While risk is limited when buying options, significant losses can occur when selling options, especially in volatile markets.

4. Costs: Brokerage and fees associated with options trading can accumulate, impacting overall profitability.

5. Market Predictions: Successful options trading often requires accurate predictions of market movements, which can be challenging.

6. Lack of Ownership: Unlike stocks, options do not represent ownership in a company. If the market moves unfavourably, the option may expire worthless.

Traders need to weigh these pros and cons, considering their risk tolerance, financial goals, and level of experience before engaging in options trading.

Options trading might seem like a financial puzzle, but it’s more like learning to ride a bike – a bit wobbly at first, but exhilarating once you get the hang of it.

Before you start options trading, you should know why most people fail in options trading.

This article decodes the basics, introducing you to the language of options and empowering you to make informed choices.