Table of Contents

Toggle

Introduction: Unveiling the Short Strangle Strategy

In the field of options trading, success is elusive, and every trader looks for a strategy that is different from the rest. Today, we will dive into the interesting world of the “Short Strangle” strategy, a method that is known for its high success rate.

The market runs in a range 70% of the time, that’s why this strategy is one of the most profitable trading strategies. In this strategy, you will benefit from time decay.

Let’s discuss the key aspects of this approach, including its profitability, risks, and comparison to other strategies.

What is the Short Strangle Options Strategy?

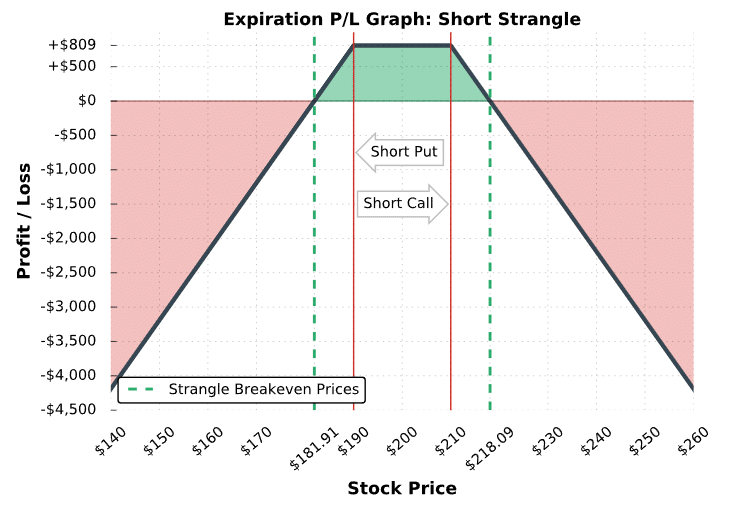

In the trading world, a short strangle is like walking a tightrope. This involves selling both a call option and a put option with the same expiration date but different strike prices. This strategy thrives when the market remains limited with limited price fluctuations. In simple terms, it’s like betting that a stock won’t make any drastic moves.

How risky is a short strangle?

Before diving into any trading strategy, it is important to understand the risks associated with it. Short Strangle is not for the faint of heart. When executed, it puts you at unlimited risk on one side. If the stock moves enough in either direction, you could suffer significant losses. It is important to tread carefully and be well-prepared to deal with possible losses.

Is a short strangle profitable?

Profitability in the world of intraday trading is the golden goose that everyone chases. The Short Strangle strategy, with its 70% success rate, can be really profitable, but it requires careful implementation and risk management. To be successful, you must accurately predict whether the stock price will remain within a specific range by the option’s expiration date.

What is the maximum loss on a short strangle?

It is important to understand the worst-case scenario. In a short strangle, your potential losses are theoretically unlimited on the call side if the stock price skyrockets or unlimited on the put side if it declines. However, this risk can be managed by setting stop-loss orders and being cautious.

What is the difference between a short strangle and a long strangle?

In the world of strangulation, there is a fundamental difference between “short” and “long”. A long strangle involves buying a call and put options with the same expiration date but different strike prices, thereby anticipating significant price changes. On the other hand, a short strangle involves selling these options, relying on stability.

Which is better: short strangle or straddle?

Two strategies, the short strangle and the straddle, are often compared. A straddle involves buying both a call and a put option at the same strike price, thereby anticipating substantial price fluctuations. The short strangle, as we have seen, involves selling options. which is better? Well, it depends on your market perspective. Straddles thrive on volatility, while short strangles thrive on stability.

Which is better: Short Strangle or Iron Condor?

Iron Condor is another strategy worth considering. It combines selling an out-of-the-money call and put option with simultaneously buying another out-of-the-money call and put option. Its objective is to take advantage of a specific range of price fluctuations. Again, the choice between Short Strangle and Iron Condor depends on your market analysis. If you’re in a bearish mood, the first might be the best option for you.

How to Execute a Short Strangle Strategy?

Executing the short strangle strategy involves a series of steps. This strategy is a combination of selling both a call option and a put option on the same underlying asset with different strike prices and the same expiration date. It is advised to backtest this strategy before executing.

Here is a simple guide to implementing the short strangle strategy:

1. Select an underlying asset: Select a stock, ETF, or any other asset you want to trade. It is important to choose an asset that you believe will remain relatively stable or within a certain price range until the option expires.

2. Do Market Analysis: Analyze the asset’s historical price movements, current market conditions and any upcoming events that may affect its price. This analysis will help you determine the appropriate strike price for your options.

3. Choose a Strike Price: Choose a strike price above the current market price for a Call option and below the current market price for a Put option. These strike prices define the range within which you expect the asset to remain.

4. Select Expiry Date: Set an expiration date for your options. The time frame for a short strangle is typically short, often ranging from a few weeks to a few months, depending on your market outlook.

5. Sell Call Option: Place a sell-to-open order for a call option with a higher strike price. This means that you are selling someone else the right to buy the underlying asset at that strike price if they choose to exercise the option.

6. Sell Put Option: Place a sell-to-open order for a put option with a lower strike price. By doing this, you are selling the right to sell the underlying asset at that strike price to someone else if they choose to exercise the option.

7. Monitoring and Management: Once your options are sold, keep a close eye on the market. If the underlying asset remains within the range defined by your strike prices by the expiry date, you will profit from the premium received when selling the option.

8. Set stop-loss orders: To manage risk, consider setting stop-loss orders. These orders automatically buy back the option if the underlying asset makes a significant move, limiting your potential losses.

9. Close the position before expiry: As the expiry date approaches, it is wise to buy back call and put options to close your position. You can also let them expire, but this involves the risk of ceding the underlying asset.

10. Review and Know: After closing your position, review the result of the trade. Evaluate what worked and what didn’t, and use this knowledge to refine your future short strangle strategies.

Remember, there is risk involved in executing a short strangle strategy, and it is essential to have a good understanding of options trading, as well as experience in analyzing the market and managing risk effectively. If you are new to options trading, consider starting with simple strategies and gradually working your way up to more complex strategies like the Short Strangle.

Summary: Mastering the Art of Intraday Trading

With thrilling highs and dangerous lows, intraday trading requires a nuanced approach. The Short Strangle strategy, with its 70% success rate, is a valuable addition to any trader’s toolkit. But remember, success depends on careful planning, risk management and a thorough understanding of the dynamics of the strategy. Whether it’s the difference between a Short Strangle and a Straddle or choosing between a Short Strangle and an Iron Condor, it all depends on your market analysis.

Related FAQs

A1: Yes, theoretically, you can. If the stock makes significant moves in one direction, your potential losses are unlimited. Therefore risk management is important in this strategy.

A2: Selecting appropriate strike prices is a matter of analyzing the stock’s historical price movements and market conditions. It is a balance between risk and potential benefit.

A3: This strategy is better suited for experienced traders who can handle the risks involved. Beginners are advised to start with less complex strategies.

A4: It can be applied to a variety of stocks, but it is more effective when trading in a range-bound market. Liquidity and option availability are also important factors.

A5: The short strangle can be useful during periods of low market volatility when you expect a stock to trade within a specific range. Avoid using it during earnings reports or major news events that could trigger significant price fluctuations.