“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

Robert Kiyosaki

Highest CAGR Stocks in Last 10 Years in India

Investing in the stock market can be profitable, but also risky. There are thousands of stocks to choose from, and finding the ones that can deliver consistent and high returns over the long term is not easy. Highest CAGR Stocks in India are the most profitable stocks in the last decade.

However, some stocks have managed to do so, and have outperformed the benchmark indices by a wide margin. In this article, we will look at 12 such stocks that have given double-digit CAGR (Compound Annual Growth Rate) in the last 10 years, according to Moneycontrol.

These stocks belong to different sectors and industries and have shown resilience and growth potential in different market conditions. We will also explain what these companies do, how they have performed and what their prospects are for the future.

By the end of this article, you’ll have a better understanding of these 12 stocks and why they’re worth considering for your portfolio.

There are various ways to measure the performance of stocks over a period of time, such as total return, compound annual growth rate (CAGR), or dividend yield.

What is the CAGR in stock market?

CAGR is a useful metric that shows the average annual rate of return for an investment over a specified time period, assuming profits are reinvested at the end of each year.

Based on research, here are some of the stocks with the highest CAGR stocks in India in the last 10 years:

Overview of these stocks based on performance:

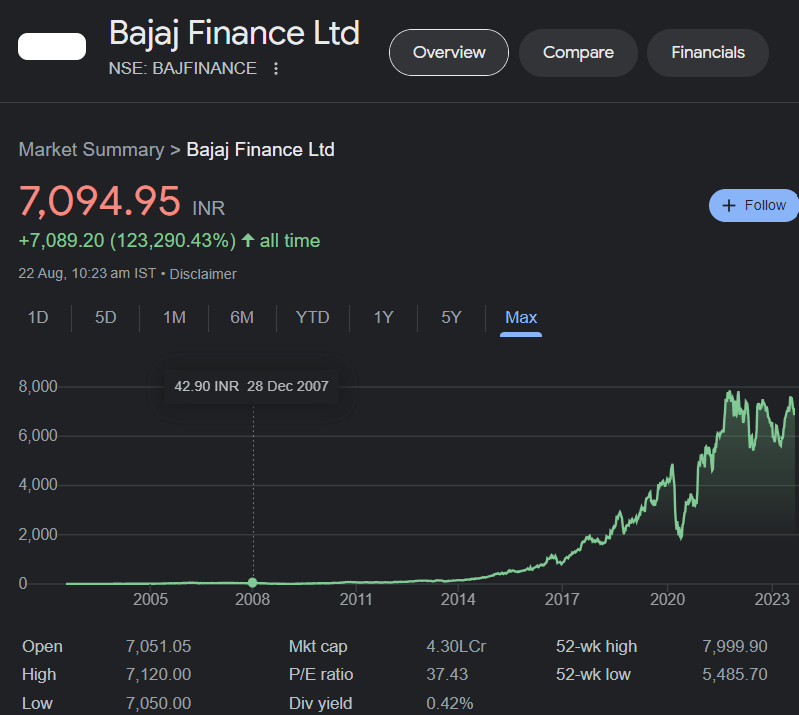

- Bajaj Finance: A non-banking financial company (NBFC) that provides consumer loans, business loans, wealth management, and insurance services.

It has a CAGR of 57.7% over the last 10 years and is a leader in the consumer finance sector in India.

- Eicher Motors: An automobile manufacturer that manufactures motorcycles, commercial vehicles and engines. It owns the prestigious Royal Enfield brand of motorcycles and has a joint venture with Volvo for trucks and buses. It has a CAGR of 31.8% over the last 10 years and is known for its premium products and loyal customer base.

- Bajaj Finserv: A holding company that has stake in Bajaj Finance, Bajaj Allianz Life Insurance and Bajaj Allianz General Insurance. It has a CAGR of 31.6% over the last 10 years and benefits from the strong performance of its subsidiaries in the financial services sector.

- Asian Paints: A leading paint company providing decorative paints, industrial coatings, home improvement products and services. It has a CAGR of 29.9% over the last 10 years and has a dominant market share in India, strong distribution network and brand recall.

- HUL: A fast moving consumer goods (FMCG) company that sells products in categories such as personal care, home care, foods and beverages. It has a CAGR of 23.9% over the last 10 years and has a diverse portfolio of brands, wide reach and innovation capabilities.

- TCS: A leading information technology (IT) services company providing software solutions, consulting, outsourcing and digital transformation services to clients across industries and geographies. It has a CAGR of 20.2% over the last 10 years and is the largest IT company in India by revenue and market capitalization.

- UPL: A global agrochemical company that manufactures crop protection products, seeds, bio-solutions and post-harvest solutions. It has a CAGR of 19.8% over the last 10 years and is present in over 130 countries with a focus on emerging markets and integrated offerings.

- Adani Transmission: A power transmission company that owns and operates transmission lines and substations across India. It has a CAGR of 18.9% over the last 10 years and is the largest private sector transmission company in India by network length.

- Deepak Nitrite: A chemical company that manufactures basic chemicals, fine and specialty chemicals, performance products and phenolics. It has a CAGR of 18.7% over the last 10 years and is one of the leading producers of Phenol and Acetone in India.

- Adani Enterprises: A diversified conglomerate that operates businesses in sectors such as coal mining and trading, renewable energy, airports, ports, logistics, gas distribution and agricultural commodities. It has a CAGR of 18.6% in the last 10 years and is a flagship company of Adani Group.

- Tanla Platforms: A cloud communications company providing solutions for messaging, voice, email, chatbots, video and blockchain to enterprises across diverse sectors. It has a CAGR of 17.9% over the last 10 years and is one of the world’s largest cloud communications providers by volume.

- Ruchi Soya: An edible oil company that produces refined oils, vanaspati, bakery fat, soy foods and biodiesel. It has a CAGR of 17.8% over the last 10 years and is one of the largest players in the edible oil industry in India.

Conclusion

These are some brief explanations about these 12 stocks that have given strong returns over a long period of time. However, past performance does not guarantee future results and you should do your own research before investing in any stock. 😊

I hope this gives you some idea about the highest CAGR stocks in India. I hope this helps you. Do you have any follow-up questions? 😊

Please note that these are not recommendations or endorsements, but just examples based on historical data. Past performance is not a guarantee of future results. You should do your own research and analysis before investing in any stock.

Hello! Great post! It was a pleasure to come across this.

Keep up the good work. Cheers!